Donors

Why Partner with Moline Regional Community Foundation?

Individuals, Families, and Businesses

Your giving is personal, a statement of your beliefs, a vision for the change you want to see in our community. There are two simple reasons to work with the Moline Regional Community Foundation:

- Personalized service tailored to your needs

- Localized expertise in philanthropy

Personalized Service

The staff are ready to meet with you, your family, and professional advisors to learn your story and reason for giving.

Spending time with you to choose the right type of fund and discuss the various ways to financially support your fund is our highest priority.

Understanding your philanthropic goals, your legacy, and helping to put your passion into action makes our community a better place.

Localized Expertise

For almost 70 years, the Foundation has been making grants to many of the same nonprofits and causes you support.

The staff is here to help answer questions about the needs of our community and help guide you to maximize your philanthropic impact.

As a nationally accredited community foundation with local oversight and community representation, the Moline Regional Community Foundation puts our donor’s philanthropic dreams first.

Let’s Get Started

The Moline Regional Community Foundation professional staff are…

- Ready to meet with you, your family, and professional advisors to learn your story and reason for giving.

- Here to help answer questions about the needs of our community and help guide you to maximize your philanthropic impact.

Types of Funds

Because you, the donor, have different aspirations for your generosity, there are a variety of options available. Once you decide, you can focus on the joy of giving.

Donor Advised Funds

A convenient and flexible way to give! Functioning like a charitable investment account, you make the tax-deductible gift today and, in the future, make recommended grants while your money is invested for growth. Funds can be endowed or non-endowed and are a great way to involve your family in your philanthropic dreams.

Designated Endowment Fund

A wonderful way to support charitable organizations close to your heart. You choose specific nonprofit organizations to receive a portion of your invested earnings each year in perpetuity. This sustainable funding provides your favorite organizations with much needed and appreciated financial stability. Funds can be named to honor an individual, family, or other entity as a legacy gift.

Field of Interest Endowed Fund

Do you have a broad area of interest you’d like to support without designating a specific nonprofit? You decide the criteria, and our professional staff and Board of Directors will ensure annual grants align with your charitable intent. Popular and flexible fund examples include supporting the environment, youth education, arts, and numerous other areas.

Scholarship Endowment Fund

Whether paying it forward or back, an endowed scholarship allows you to support the next generation of community leaders financially. You establish the criteria, decide if you want to be involved in the selection process, and then enjoy the results of your giving. It’s a perfect way to honor a family member, a teacher, or someone influential in your life.

Nonprofit Partner Fund

As local nonprofits seek to generate reliable annual income, a nonprofit partner fund allows loyal donors the opportunity to support your mission in perpetuity. Benefits to the nonprofit include professional investment management, minimal administrative burdens, and flexible revenue. It’s a simple and straightforward way to empower your key supporters through planned giving.

Unrestricted Fund

Do you wish to support our community’s evolving needs over time? Establish an unrestricted fund, and a committee of local leaders will award annual grants in your name. Or show your love for the community by joining hundreds of others who have given to existing unrestricted funds such as Forever, Make A Difference, or Community Impact.

Ways to Give

Your generosity, your way. Find the giving option that works best for you.

Checks or Online Giving

Ready to make a gift to an existing fund? You can click here to donate, mail, or drop off a check to:

Moline Regional Community Foundation

1601 River Drive, Suite 210

Moline, IL 61265

Make checks payable to Moline Regional Community Foundation and include the specific fund you’d like to support. View a full list of funds or give online.

Stocks & Market Securities

Work with your investment professional to facilitate a transfer. This allows you to deduct the current market value as a charitable contribution and avoid capital gains tax on the appreciation.

Bequests

Retirement Assets

If you have unused retirement assets (IRA, 401(k), 403(b), pension, etc.), consider donating them to your fund or directly to the Foundation. Donors aged 70½ and older can make tax- free Qualified Charitable Distributions (QCDs) of up to 100,000 per individual, or 200,000 per married couple, from your traditional IRAs. For donors 72 and older, QCDs can count toward Required Minimum Distributions (RMDs) while lowering Adjusted Gross Income. Distributions to any Foundation fund (except donor-advised funds) qualify, but must be made directly from your IRA account.

Life Insurance

Designate the Foundation as a beneficiary of your life insurance policy. You can transfer ownership of a paid-up policy, donate policy dividends, or name the MRCF as the policy’s owner and beneficiary, making annual tax-deductible gifts to cover premiums.

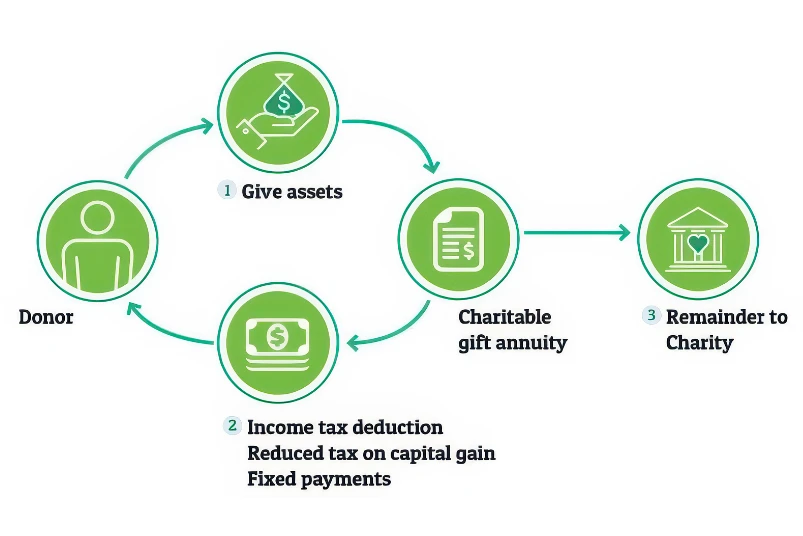

Charitable Gift Annuities

Other Options

While less common, charitable lead or remainder trusts, gifts of land, businesses, commodities, antiquities, and cryptocurrency are also options. Contact us to discuss further.

How a Charitable Gift Annuity Works

A Charitable Gift Annuity is based on a contract between you and the Moline Regional Community Foundation. You can donate cash or stock, and in return, the MRCF provides fixed payments to you and/or a loved one. Payments are based on the age of the recipient(s) and offer an opportunity for tax-free income.

- Payments can start immediately or be deferred for larger payout amounts.

- Donors using cash receive an immediate income tax deduction (if itemizing).

- Donors using stock can avoid capital gains tax.

After your lifetime, the remaining value of the annuity will be distributed to the endowment fund you established, supporting the nonprofits or causes you care about.

Illinois Gives Tax Credit Act

Effective January 1, 2025, any Illinois taxpayer making a financial gift to an endowed fund at an accredited community foundation will be eligible for an additional 25% Illinois tax credit. The goal is to inspire and incentivize permanent support for the nonprofits who work daily to improve Illinois residents’ quality of life

Questions and Answers

What does the Illinois Tax Credit Act do?

Individual donors may receive an additional 25% tax credit for endowed gifts to Illinois Community Foundations. The goal is to encourage permanent endowments benefitting IL communities forever.

How much is available?

5M in tax credits, allowing for 20M in donations.

Individual taxpayers can claim up to $100,000 in tax credits, equating to a $400,000 donation.

Is this a federal tax credit?

This is not a federal tax credit; it only impacts Illinois income tax.

Do I have to be an Illinois resident?

Whether you’re an Illinois resident or not, paying Illinois income tax makes you eligible to claim the tax credit. It’s designed to be inclusive, ensuring everyone contributing to the Illinois community can benefit.

Who qualifies as a “donor”?

Any Illinois taxpayer, including individual and joint filers, corporations, partnerships, trusts, and estates, can make an eligible gift to a community foundation. This Act is designed to include all Illinois taxpayers, ensuring everyone can contribute to the community.

What is an “eligible gift”?

A donation to an endowed fund at an accredited Illinois community foundation. Moline Regional Community Foundation is an accredited Illinois Community Foundation.

What assets can become gifts?

At Moline Regional Community Foundation, various endowed fund types are available, including designated fields of interest, scholarships, and nonprofit partner funds.

What is an “endowed fund”?

An endowed fund is permanently invested to allow for growth and preserve assets. Investment earnings are used to make annual payouts to Illinois nonprofits. Moline Regional Community Foundation’s payout rate is currently at 4.25% of the net assets calculated on a 4-year rolling average.

What types of funds can become endowed?

At Moline Regional Community Foundation, various endowed fund types are available, including designated fields of interest, scholarships, and nonprofit partner funds.

Can these endowed funds benefit charities outside of Illinois?

Only Illinois nonprofits will benefit from the endowed gifts.

Are gifts to any charitable organization eligible for this tax credit?

Only gifts to permanent endowments at Moline Regional Community Foundation are eligible. Gifts given directly to nonprofits, private foundations, and family foundations are not eligible.

MyTax Illinois Gives Process

Verify Eligibility to File on MyTax Illinois

- Ensure you have previously filed a Form IL-1040, Illinois Individual Income Tax Return, with the Illinois Department of Revenue.

- If this is your first time using MyTax Illinois, confirm your mailing address on file with the Illinois Department of Revenue is current, as this will be critical for receiving correspondence.

Set Up Your MyTax Illinois Account

- Go to the MyTax Illinois website (mytax.illinois.gov).

- You will need a Letter ID from a notice issued by the Illinois Department of Revenue within the last 90 days. If you already have an ID, proceed with creating your account.

- If you do not have a Letter ID, click “Cancel” on the login creation page and select the “Request a Letter ID” link in the Individuals panel of the homepage.

- A notice with the Letter ID will be mailed to the address on file within 10 days.

Apply for a Contribution Authorization Certificate (CAC)

- Once your MyTax Illinois account is active, log in and apply for a CAC by selecting the Qualified Charitable Foundation (QCF) from the dropdown menu.

- Enter the donation amount you plan to give to the QCF. Double-check all details to ensure accuracy.

- Submit your application. The CAC will typically be available in your MyTax Illinois account shortly after submission.

Apply for a Contribution Authorization Certificate (CAC)

- Provide the CAC to the QCF

Make Your Donation

- Complete your donation to the QCF within 15 calendar days of the CAC’s issuance. Missing this deadline will invalidate the CAC.

QCF Confirmation

- QCF will log into their MyTax Illinois account, locate the CAC you provided, and confirm the donation has been received.

Receive Your Certificate of Receipt (COR)

- After the QCF confirms your donation, you will receive a Certificate of Receipt (COR). This document will be available in your MyTax Illinois account, typically within one day.

Troubleshooting and Support

- If you encounter any issues, such as delays in receiving your Letter ID, difficulties setting up your MyTax Illinois account, or problems obtaining your CAC or COR, contact Paul Plagenz at paulplagenz@molineregionalcf.org or call 309.581.2972.

Eligible Illinois Endowed Funds

Arc of the Quad Cities

Black Hawk College Foundation

Center for Belgian Culture

East Moline Community Fund

East Moline Public Library

Family Outreach Community Center

Forever Fund

Friendship Manor/Silver Cross

Friends of Moline Parks & Recreation

Genesius Guild

GiGi’s Playhouse Quad Cities

Living Proof Exhibit

Make a Difference

Mercer County Forever Fund

Midwest Hope & Healing

Moline High School National Honor Society

Moline Public Library

Moline Public Schools

Niabi Zoological Society

Quad Cities Diabetes Association

Quad Cities Youth Conference

Quad City Music Guild

Rock Island Federation of Women’s Club

Rockridge Schools Foundation

Sherrard Academic Foundation

SAL Family Services

Two Rivers YMCA

Youth Hope

Youth Service Bureau of RI County

Donor Stories

Playlist

2:49