Three Easy Ways to Get Started

-

1. Will Bequests

One of the easiest ways to make a legacy is with the help of an attorney, include language in your will or trust specifying a gift be made to the fund of your choice at the Moline Regional Community Foundation.

Sample wording could include:

I give to the Moline Regional Community Foundation, a nonprofit corporation located in Moline, Illinois, an amount equal to [ _% ] percent of the total value of the assets in my estate at the time of my death.

Or if for a specific established fund:

I give to the Moline Regional Community Foundation, a nonprofit corporation located in Moline, Illinois, an amount equal to [ _% ] percent of the total value of the assets at the time of my death to be added to the [fund name] and used in accordance with the written agreement entered into by me and the Foundation.

-

2. Qualified Charitable Distribution

A smart way to make a gift maximum of $100,000 from an individual retirement account (IRA) for those over the age of 70½ whether you take the standard deduction or itemize. Donors can reduce their adjusted gross income by making a gift to a nonprofit (Moline Regional Community Foundation).

If you are older than 73, your donation counts towards your required minimum distributions (RMD). Talk to your Accountant and/or Financial Planner to maximize the impact of your giving.

-

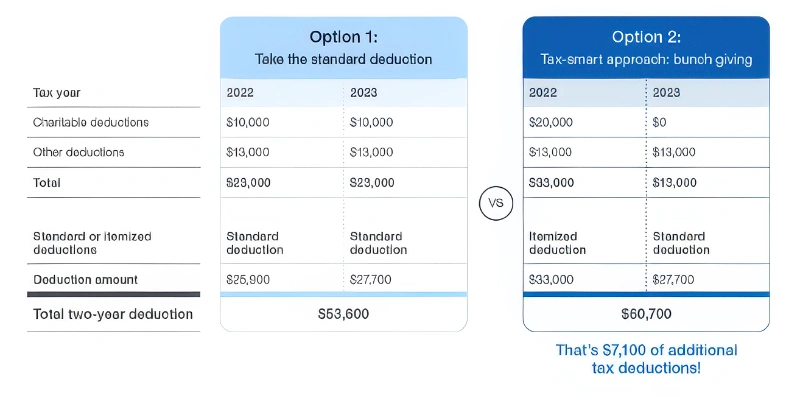

3. Bunching Your Tax Write-Offs

A simple method to increase your donations rates with a reduced tax liability over 2. More than per bus. Donors remain in your one, then take the standard calculation in your bus.

An Example